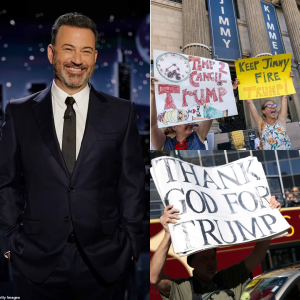

Disney’s stock dropped 1.9% in early US trading after the company indefinitely suspended Jimmy Kimmel’s talk show, “Jimmy Kimmel Live,” following Kimmel’s controversial remarks about a stabbing incident involving Charlie Kirk on the show. Disney executives plan to meet with Kimmel to discuss the future of the program.

Disney’s stock dropped by 1.9% in early US trading on September 12, 2025, following the company’s decision to indefinitely suspend the airing of “Jimmy Kimmel Live!” after controversial remarks made by the show’s host, Jimmy Kimmel, about a stabbing incident involving conservative activist Charlie Kirk Disney (DIS) Pulls [1].

The suspension came after Kimmel’s comments on the show, where he criticized those who tried to characterize the assailant as anything other than a conservative. This decision was met with criticism from some quarters, including those concerned about First Amendment protections and the freedom of speech Everything Charlie Kirk Said About Jimmy Kimmel[2].

The Walt Disney Co. operates in three global business segments: entertainment, sports, and experiences. The entertainment segment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Disney also engages in movie and television production and distribution. The sports segment houses ESPN and the ESPN+ streaming service, while the experiences segment contains Disney’s theme parks and vacation destinations, benefiting from merchandise licensing Disney (DIS) Pulls [1].

Disney’s financial health shows a mix of strengths and warning signs. The company’s market capitalization stands at $206.51 billion, with a market cap of $206.51 billion. Disney’s revenue for the trailing twelve months is $94.54 billion, with a 3-year growth rate of 10.6%. The company’s operating margin is 14.78% and net margin is 12.22%. However, the Altman Z-Score of 2.56 indicates some financial stress, and there has been insider selling activity with 1,971 shares sold in the past three months Disney (DIS) Pulls [1].

The suspension of “Jimmy Kimmel Live!” has drawn condemnation from those concerned about First Amendment protections. Christopher Anders, director of the Democracy and Technology Division at the American Civil Liberties Union, wrote in a statement: “This is beyond McCarthyism. Trump officials are repeatedly abusing their power to stop ideas they don’t like, deciding who can speak, write, and even joke. The Trump administration’s actions, paired with ABC’s capitulation, represent a grave threat to our First Amendment freedoms” Everything Charlie Kirk Said About Jimmy Kimmel[2].

Disney executives plan to meet with Kimmel to discuss the future of the program. The company’s valuation metrics provide insights into its market positioning. The P/E ratio is 18, close to its 5-year low, indicating potential undervaluation. The P/S ratio of 2.2 is near its 1-year high, reflecting market confidence. Analyst recommendations are positive, with a target price of $133.6 and a recommendation score of 1.9 Disney (DIS) Pulls [1].

The company’s risk profile includes several considerations. The beta of 1.71 indicates higher volatility compared to the market. Sector-specific risks include the volatility inherent in the media industry and regulatory challenges Disney (DIS) Pulls [1].

Ask Aime: How will Disney’s suspension of “Jimmy Kimmel Live!” impact its stock prices and overall market position?